Announcing the availability of Credit Union Compliance Management System™ to all Nebraska member credit unions, a powerful tool to help your credit union better manage regulatory compliance.

The Nebraska Credit Union League is pleased to announce Credit Union Compliance Management System™ (CU CMS) as a member benefit, with technology by Quantivate.

This easy-to-use, centralized system is designed to:

- Reduce non-compliance risk

- Keep credit unions informed

- Improve accountability and alignment

- Decrease stress on staff and resources

Credit Union Compliance Management System™ is an intuitive, scalable compliance solution that includes timely regulation alerts, guided workflows and an advertising review tool, as well as a federal and state law/regulation library, evidence tracking, RISK alerts from CUNA Mutual Group and easy-to-use dashboards.

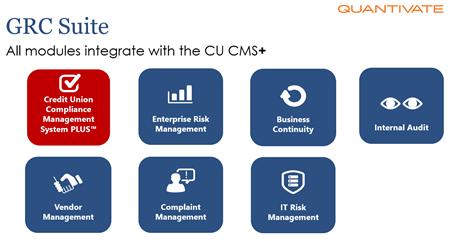

For those credit unions with more complex compliance needs, there is an enhanced, for-fee version of the system, Credit Union Compliance Management System PLUS™ (CU CMS+). It includes all of the functionality of the member benefit, PLUS additional and advanced functionality for those credit unions who need more.

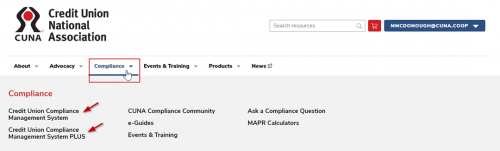

Learn more or sign up:

- Visit org

- Select the Compliance

- Select the version you want to learn more about:

- Credit Union Compliance Management System (member benefit)

- Credit Union Compliance Management System PLUS (enhanced, for-fee)

Everything your credit union needs to manage regulatory compliance will be at your fingertips – and with additional modules available by Quantivate, your credit union has access to an entire GRC suite.

Welcome to a new day for credit union compliance.

Megan McDonough (Smith), Compliance Solutions System Analyst (CUNA CU CMS Product Manager)

Questions? Email mmcdonough@cuna.coop