2020 will certainly be remembered as the year Covid-19 changed the world as we know it. Likewise, the associated “Lockdown Recession” is already changing the way many credit union leaders manage their balance sheets. With loan demand dropping in most parts of the country and stimulus deposits adding to already bloated cash positions, proactive strategic planning has never been more crucial. More to the point, proper liquidity management may offer some of the additional margin and income credit unions desperately need.

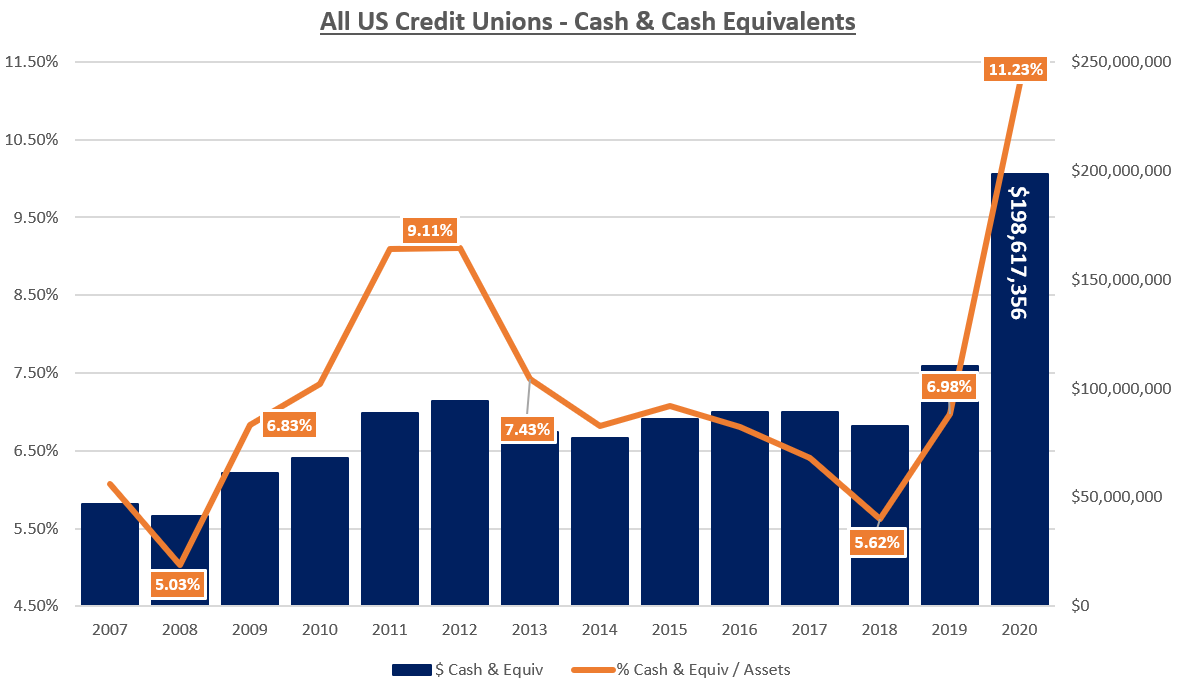

Cash and cash equivalents as a percentage of total assets reached 6.98% as of year-end 2019. The surge from 5.62% to 6.98%, which occurred 2018 to 2019, very closely mimics the pop in liquidity experienced in 2008 to 2009 (the beginning of the Great Recession). However, it is the three years after 2009 that we are most focused on. Liquidity continued to grow (hitting 9.11% in 2011/2012) as the industry slowly recovered from weakened loan demand and increased deposits from an embattled member base. The zero-bound range on overnights at the time led to significant drops in overall interest income. As we hit the midpoint of 2020, it appears that the industry must once again prepare to navigate similar waters. As of June 30, 2020, the industry was sitting at a record high allocation of 11.23% of assets in cash and cash equivalents. More than 2% higher than the peak of the Great Recession.

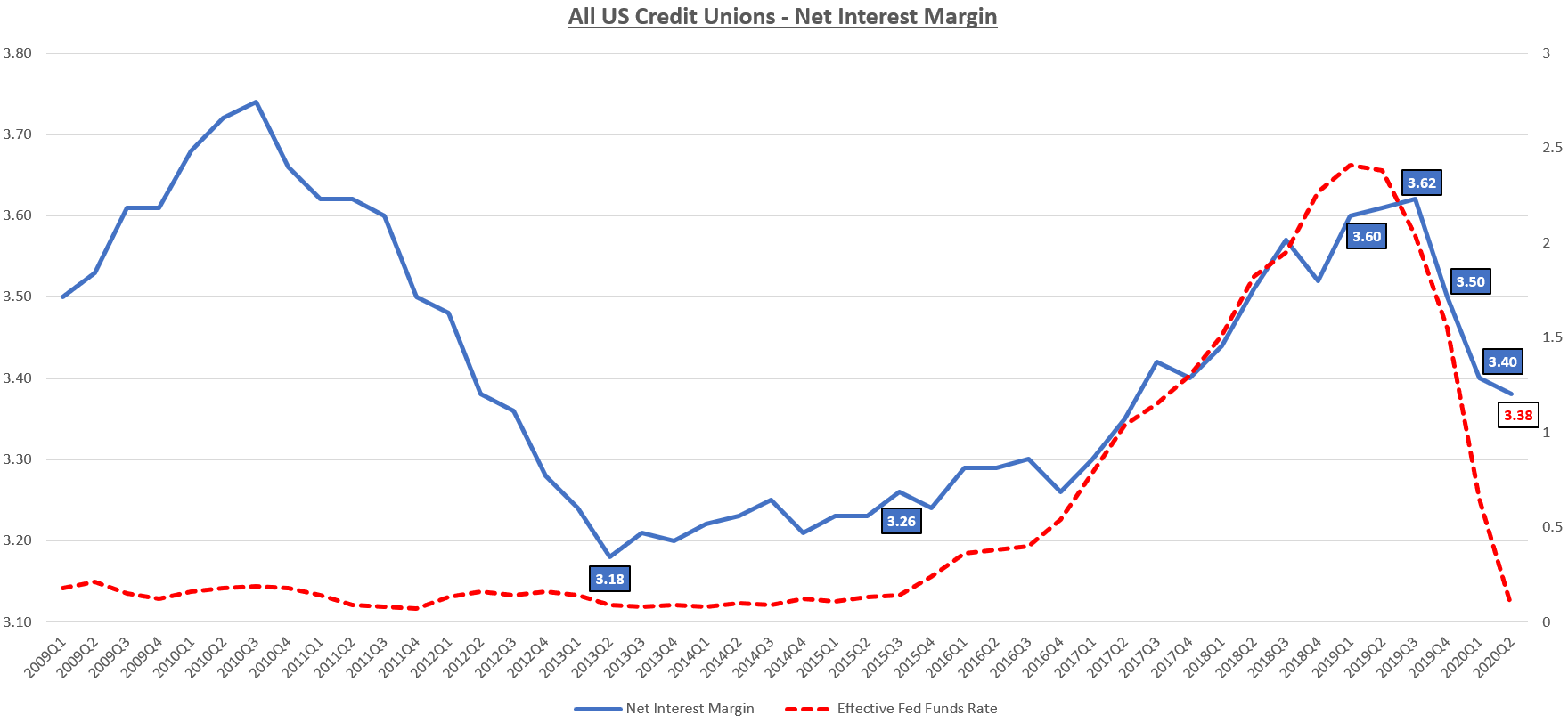

Although we still do not fully understand COVID-19 or the longer-term impact it will have on our economy, we are not completely powerless when it comes to making better-informed decisions. The biggest risk coming from our record levels of cash is the damage to margins and earnings. With overnight balances yielding just 8.5bps and industry cost of funds around 90bps, it doesn’t take long for negative spreads to eat into margins and eventually net worth. In fact, the chart below illustrates that overall industry margins have tightened by 24bps in just the last 12 months.

While it can be tempting to “sit on the sidelines” and hope for a V-shaped recovery, we must weigh the potential negative implications from that approach if we end up being wrong. The correct strategy here is not to make a one-way bet in either direction. We can remain positioned for a quicker than expected recovery while also improving our hedge against a longer-term low rate environment like 2007–2012. It all comes down to executable ALM management.

As of 06/30/2020 the industry was carrying just over $198 billion in cash and cash equivalents. If we assume the same 90bps cost of funds figure from earlier, those funds are earning a negative spread of -.815%. This equates to “lost” income of roughly $1.6B a year. To put it quite simply, we cannot afford to accept an income loss of that magnitude when we do not know how long the current situation could last. In fact, every day that we continue to receive 8.5bps instead of investing those funds, the foregone income becomes harder and harder to recover.

![]()

The good news is the yield curve has steepened a bit since the Fed made their historic announcement regarding inflation. The market is now demanding a slightly higher yield on longer assets considering that inflation may be allowed to increase above the Fed’s normal 2% goal for a “period of time.” In this environment, liquidity management is absolutely key. However, we need to realize that having too much liquidity sitting in overnights can be just as dangerous and detrimental as not having enough.

Andrew Okolski is the Director of Credit Union and Municipality Strategies at The Baker Group. He works directly with clients in a broad range of areas including ALM, education, portfolio management, interest rate risk management, strategic planning, regulatory issues, and wholesale market strategies for credit unions. Before joining the firm, he spent fifteen years building and managing a financial strategies group at a New York broker/dealer with a specific focus on the credit union industry. Andy holds a Bachelor of Business Administration Degree from Long Island University – C.W. Post. Contact: 800-937-2257, andyo@GoBaker.com.