IN TURBULENT TIMES LIKE THESE, CREDIT PROVIDES THE FINANCIAL SUPPORT MEMBERS NEED

By Beth Phillips, Director, Strategic Growth, CO-OP Financial Services

This article previously appeared on CUInsight.com

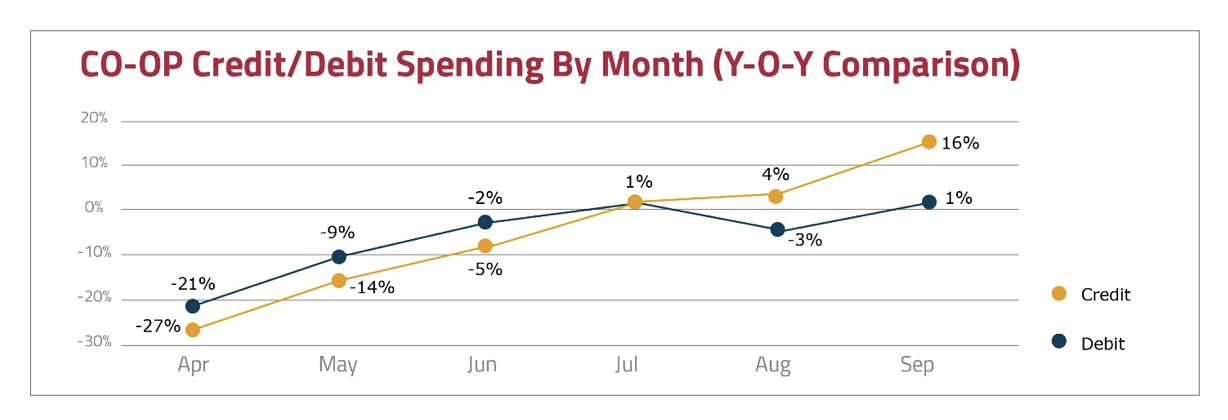

It’s hard to believe that we’re almost eight months into the COVID-19 pandemic. The last several months have given us a roller coaster of an economy that has left many consumers financially-vulnerable and uncertain about their long-term financial outlook. Looking at the data from thousands of credit unions within the CO-OP Credit and Debit portfolio, we’ve seen member spending levels climb back over the last few weeks; however, with many Americans still unemployed and the next government stimulus package potentially in limbo, we can still expect some bumps in the road to recovery ahead.

If history is any indicator of what we can expect in the upcoming months, then we’ll likely see a shift to credit spending among credit union members. A review of September payment transaction data across CO-OP’s credit and debit portfolios indeed shows that credit purchase activity is picking up after months of depressed volume, while debit spending is beginning to fade. Credit transaction counts and amounts increased for the month by 16% and 17%, respectively, compared with September 2019. This tells us that as more consumers suffer from reduced income and access to cash in their checking accounts, they are relying more on credit for daily expenses.

History also tells us that credit unions are well-equipped to respond to economic turbulence and the resulting shift towards credit. This is because consumers tend to flock towards the lower interest rate credit cards and better terms that credit unions can offer. According to TRK Advisors, in the months following the Great Recession of 2008-2009 card balances at traditional banks plummeted while credit unions actually saw an increase in card balances.

Interestingly, credit unions have also fared better historically than large issuers in managing credit portfolio risk. During the Great Recession, bank charge-offs hit a high of over 9%, whereas credit union charge-offs maxed out at slightly above 4%, TRK Advisors found.

All of this tells us that there are distinct economic advantages to growing your credit portfolio. But going beyond that, credit is more important than ever because it provides the financial support your members need. While large issuers and credit card providers continue to slash credit lines, credit unions can be the compassionate payments alternative (as they always have been). In the early months of the pandemic, this meant offering skip-a-payment and interest relief programs to members, which we saw many of our credit unions do. Now, credit unions should focus on capturing top-of-wallet opportunities within their cardholder base and supplementing their card programs with tools like card controls and alerts that help members track and better manage their spend.

Credit Card Top-of-Wallet Opportunities Ahead of the Holiday Shopping Season

With digital expected to dominate a much larger portion of holiday shopping this year, now is the time to start pushing to get your cards into your members’ digital wallets. Consider offering special incentives on high-volume online shopping categories. Within CO-OP’s credit portfolio, we have seen strong year-over-year growth across the following categories:

- Home supply and hardware stores – pandemic Do It Yourself projects continue to be a popular trend as members spend more time at home.

- Wholesale clubs – we’ve seen a trend towards bulk-shopping at big box retailers like Walmart, Target, Costco and Sam’s Club, where members can purchase necessities like groceries and medications along with home goods and other items. By visiting fewer stores, consumers are likely looking to limit their exposure to COVID-19.

- Car rentals – car rentals have been on an improving trend since the beginning of the summer, perhaps reflecting cardholders’ desire for “staycation” and “local experience” activities as safer and more economical alternatives to traditional vacations. In contrast, most travel categories, including airlines and hotels, continue to struggle.

- Niche spend categories – political organizations, online gambling and digital goods continue to show phenomenal growth year-over-year. In the case of political contributions, this is not surprising given this year’s presidential election cycle. And perhaps my favorite trend to see has been the remarkable growth in snowmobile dealer purchases!

Amazon surprised us all by announcing that their highly-anticipated Prime Day moved from July to October 13 this year. We have seen significant increases in Amazon spending all throughout COVID-19, including double-digit year-over-year growth every month since April (and 50% year-over-year growth in September). No surprise, this year Amazon Prime Day was a huge hit with credit union members; our own analysis of CO-OP Credit and Debit portfolios found that Amazon Prime Day transactions increased 51% year over year (read our full analysis)

Even if you weren’t able to spin up a campaign ahead of Prime Day, fear not as we anticipate that, given the close proximity between Amazon Prime Day and the holidays, this year we’re going to see a prolonged spending boost that will last over the next several weeks. (CO-OP’s SmartGrowth team can help you there.)

As the pandemic recession continues, one thing is certain: credit unions can and must continue to support their members by focusing on payments. Payments are the foundation upon which members build primary financial relationships with their credit unions. In turbulent times like these, payments can help you address the needs of your most financially-vulnerable members while also driving deeper member relationships.

Need help analyzing your payments strategy? CO-OP’s SmartGrowth experts are ready to work with your credit union to help you analyze your portfolio data, identify your members’ needs and develop a strategy to help meet them.